What you need to know about buying a house in Australia

The process of buying a property is always complex and full of unexpected hurdles. It becomes even more confusing when buying real estate outside of your own country when you are not familiar with the relevant laws and terminology.

In this article, we explain the common terms you will encounter when buying an investment property in Australia.

Before you buy

Comparison rate

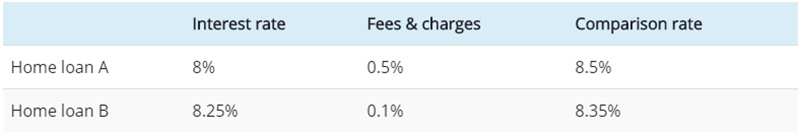

The comparison rate on a home loan is the actual interest rate on the loan plus all fees and charges associated with the loan. Comparison rates allow consumers to conduct a like-for-like review of loans from different lenders.

The example below shows how the loan with the lower quoted interest rate can have a higher comparison rate once fees and charges are added.

Source: moneysmart.gov.au

It is a legal requirement in Australia that all mortgage providers make a comparison rate available to consumers.

Loan-to-value ratio (LVR)

The loan-to-value ratio is used by mortgage providers to evaluate a borrower’s risk of default.

The LVR is calculated by dividing the loan amount by the actual value of the property.

For example, if a loan of $600,000 is required to buy a $1 million property, the LVR is 60%. Brighten Home Loans lends up to a maximum LVR of 80%, meaning we would loan up to $800,000 on a $1 million property.

The Australian Government has recently forced banks to tighten their lending standards, which has resulted in many institutions lowering their maximum LVRs on loans to non-residents to 60%.

Deposit

The home loan deposit is the amount of cash that you already have to contribute to the cost of the property before applying for the home loan. For example, if you want to borrow $700,000 to by a $900,000 property, your deposit is $200,000.

The house deposit, or holding deposit, is the refundable amount that is paid by the buyer to the seller once a verbal offer has been accepted. It is not compulsory. The deposit shows the seller that you are a serious buyer but it does not legally secure the property. The holding deposit is usually a few hundred dollars.

When buying off the plan, the developer will almost always require a holding deposit from the buyer with the balance paid upon settlement of the property.

Gazumping

Gazumping is the practice of selling a property to a third party after a verbal offer has been accepted. It can be an extremely frustrating experience for buyers.

As the sale is not secure until contracts are exchanged, sellers are able to accept a higher offer until this point, even if a holding deposit has been paid.

Mortgage valuation

These valuations are commissioned by lenders. They help lenders determine the appropriate LVR by independently confirming the value of the property.

The cost of the mortgage valuation (also known as a bank valuation) is payable by the borrower and is usually added to the loan amount.

Building inspections

It is a very good idea to have a building inspection done on a property before you buy. This ensures that any costly repairs, such as problems with electrical wiring, are rectified before you take ownership or subtracted from the purchase price.

Once you purchase the property, it is much more difficult to have building faults repaired at no charge.

Often sellers or real estate agents will supply inspection reports but it is safer to have your own report done by a professional inspection service. Also, check that the inspection service has professional indemnity insurance to cover the repairs of any problems that are missed during the inspection.

Buying a property

Cooling-off period

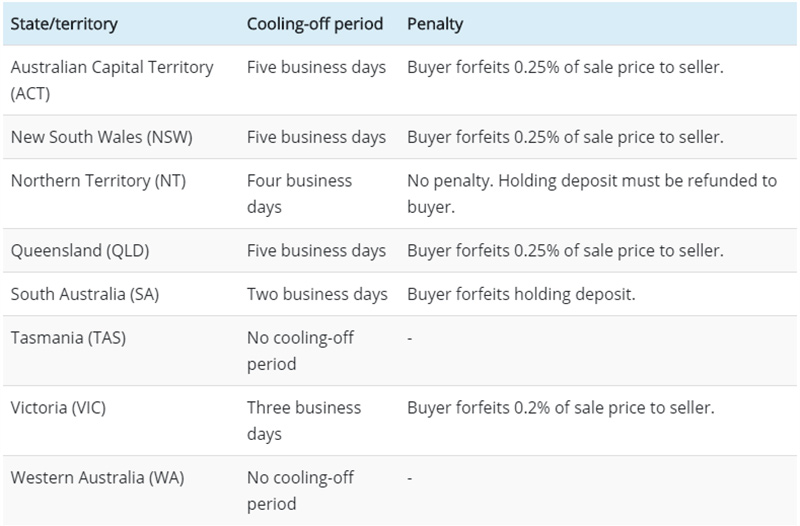

This is the period after the signing of the contract of sale during which either the seller or the buyer can cancel the contract. However, there is usually a financial penalty for backing out of the contract during the cooling-off period. The rules around cooling-off periods and financial penalties vary between the different states and territories of Australia.

Conveyancing

Conveyancing is the legal term for the transferral of title (the document showing proof of ownership) from the seller to the buyer. Conveyancing lawyers also provide advice on avoiding problems with the transfer of ownership.

Stamp duty

Stamp duty is a state and territory government tax on all property purchases. It is based on factors such as the value of the property on the date that contracts are exchanged, the location of the property, the type of home loan that the buyer has, and whether the buyer is a resident or non-resident.

Brighten Home Loans has a stamp duty calculator to help you work out the amount you will have to pay.

The time to pay stamp duty after settlement of the sale of property varies greatly between the different states and territories of Australia.

If stamp duty is not paid within the designated time, penalty fees are generally charged.

Owning a property

Council rates

Every municipal council in Australia charges homeowners a property tax known as rates. Councils charge rates to cover expenses such as waste collection, street cleaning, and stormwater management. The amount of rate charged is based on the value of your property. The method of calculating rates varies between different councils.

Strata levy/fee

When you buy a unit or apartment in development, it is likely that you will have to pay an annual strata levy or strata fee on top of your council rates. This covers the shared costs of the property owners in the building such as gardening, painting, and maintenance of facilities such as swimming pools, gyms, and elevators. The cost of strata fees is generally proportionate to the value of the residences in the building.

Land tax

Land tax is a state levy payable by anyone owning a residential property or vacant land that is not their principal place of residence i.e. an investment property. Land tax is levied by all states and territories of Australia except the Northern Territory.

For non-residents, most states and territories also levy an additional surcharge on ownership. Each state and territory has its own method of calculating land tax.

In NSW, for example, in 2018 any property valued at under $629,000 is free from land tax. The tax is charged at $100 and 1.6% of the value between the lower threshold of $629,000 and the upper threshold of $3,846,000. The tax increases to 2% for every dollar that a property is valued over $3,846,000.

For example, Henry is a Hong Kong resident who buys an investment property in Sydney for $4 million. His annual land tax is calculated at:

Estimated land tax payable: $54,652

Land tax surcharge: $80,000

Total payable: $134,652